* Strung, and not strung, for harvest

* Random observation: Hersbrucker Pure?

* The aromas of IPA

* Hop profile: Harlequin

Welcome to Vol. 8, No. 2. One quick programming note. Last month, I promised a report from harvest in New Zealand. That will have to wait until July.

EMPTY TRELLISES

Farmers in the Northwest have strung 6,720 acres of trellises with Citra hops, to be harvested in September. That is about five times more acres than growers in England will harvest of all varieties this year.

However, US farmers didn’t string 2,136 acres with Citra that they did in 2023, or 5,324 that they did in 2022.

This is not an example of demand for Citra shifting to, say, UK-grown Harlequin (see below). This is an example of how out of whack aroma hop supply and demand are right now. A USDA report released Thursday indicates farmers will harvest 9,775 fewer acres in 2024 than they did in 2023, and 15,242 fewer than they did in in 2022.

(Some of those acres may simply remain empty, while crops may be grown on others. The photo above is not new. It was taken in Oregon in 2013, before aroma hops filled fields that were idled after a short-lived surge in alpha demand.)

I have already written a bit here, plus more at Brewing Industry Guide on why this is necessary. That has not changed in recent months.

The question now for hop producers and consumers is: What happens next?

I do not know. I will repeat that. I do not know. I will not pretend. Instead, a few numbers, offered in small bites. Some are more significant for brewers, some for farmers, some for beer drinkers.

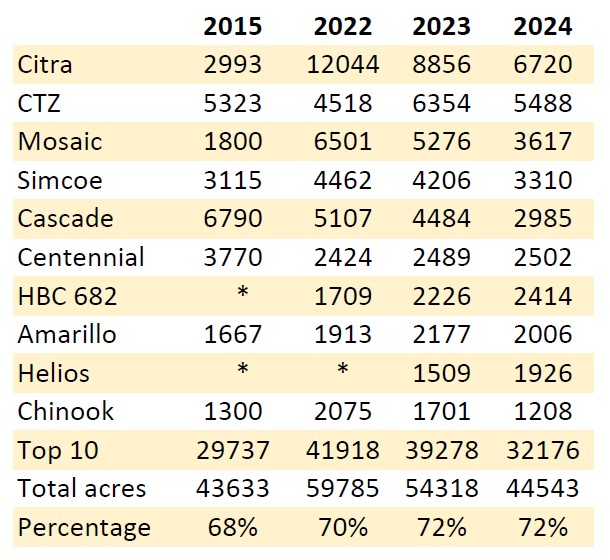

This acreage chart illustrates how a list of the 10 most grown varieties has changed, or not changed. I have ordered the hops based on 2024 acreage, and included 2015 because the reductions in 2023 and 2024 have pretty much brought acreage back to where it was nine years ago.

(As you can see, the members of the top ten have remained much the same. HBC 682 and Helios are varieties that were not around in 2015. Helios was still an experimental variety in 2022. In 2015, the top ten included Summit and Willamette. In 2022, El Dorado was No. 10. Their numbers are included in the top ten sums.)

At the American Hop Convention in January, John I. Haas CEO Tom Davis presented this chart which shows little difference in craft beer production between 2015 and 2023. It would seem increasing production from 79 million pounds in 2015 to 115 million pounds in 2021 at the same time demand was barely growing was a mistake.

Davis said that the US hop industry has 35-to-40-million-pound aroma hop surplus. Nobody disagrees. In the last six years, farms in the Northwest have produced an average of 1,848 pounds for hops per acres. Across 9,775 acres (this year’s reduction), that would amount to about 18 million pounds of hops.

It would, and should, put a serious dent the surplus. Still, it will take much longer for supply and demand to return to balance. You are going to see flash sales like this recent one from Yakima Chief Hops for a while.

(Although eliminating those pounds is necessary, it also is painful. The average farm gate price last year was $5.40, so we are talking about almost $100 million pounds of hops.)

I assembled the chart not only to visualize how acreage has shifted while remaining much the same in total, but because I was curious about possible consolidation at the top. That overall acreage decreased 25 percent while acreage of the top ten declined 23 percent should raise concerns about shrinking diversity.

Yes, there is plenty going on in that other 28 percent that is worth exploring. Sabro is a more extreme example. Washington farmers harvested 1,120 acres in 2021 and Oregon farmers 225 (the sum would be put Sabro in the top 10 this year). Washington farmers strung only 203 acres in 2023 and again in 2024, and Oregon farmers reported none.

Sabro is a “love it or hate it” hop. She might not have the future hop merchants expected a few years ago, but plenty of brewers are fans. Once the industry works through this aroma surplus, how many pounds will brewers need every year? To repeat myself, I do not know.

Enough about things I do not know. I will finish with something that could have been a random observation here, had I not posted it earlier at the Hop Queries site. Citra surpassed Saaz as the most popular aroma hop worldwide several years ago. Saaz might reclaim the crown in 2024. The math now versus a month ago gets a little trickier, because the Hopsteiner estimate for Citra acres strung turned out to be lower than the one from the USDA. We will have to wait until after harvest to learn which side of 5,000 metric tons each falls on.

RANDOM OBSERVATION

Chalk it up to coincidence. One recently named variety and two experimental cultivars are all daughters of Hersbrucker Pure. Lest you think that Hersbrucker Pure previously established herself as some sort of supermom, looking through the heritage—when that heritage has been shared—of hops bred in the last 30 years Hersbrucker Pure’s name does not appear even once.

Curiously, Hersbrucker Pure is not directly related to Hersbrucker Spät (otherwise simply known as Hersbrucker), a landrace variety sometimes classified as “noble.” Pure is 42 percent Hallertauer Mittelfrüh, 13 percent Saazer, 22 percent German wild hop, and 23 percent unknown. She was bred as a replacement for Spät.

Val Peacock, manager of hop technology at Anheuser-Busch from 1989 through 2008, provides a little history. In the early 1990s, the German Society of Hop Research released Hallertau Tradition, Spalt Select, and Hersbrucker Pure. Tradition was marketed as a substitute for Hallertau Mittelfrüh, which farmers were removing for agronomic reasons.

Many brewers who previously used Hersbrucker as a Mittelfrüh replacement adopted Tradition instead. A-B was not among them.

At the same time in the 1990s that Boston Beer began offering growers a premium to put Mittelfrüh back in the ground, those growers discovered ways to farm the hop so it was more dependable. A-B soon replaced most of its Hersbrucker contracts in favor of Mittelfrüh, and she became the German hop the brewery purchased more of from 1997 to 2008 than any other. “Most people do not remember Hersbrucker Pure because no one ever contracted for it,” Peacock explains. “Hersbrucker itself was a substitute hop, so why would anyone buy a substitute for it?”

However, it appears she makes a pretty good mother. Exhibits A, B and C:

* Audacia (5.5-6.4% alpha acids, 3-3.4% beta acids, 1.1-1.5 mL/100 grams total oil). From Indie Hops, a cross between Pure and a male from Shawn Townsend’s Indie Hops breeding program.

As her heritage suggests, used in a lager Audacia might pass for a European grown hop, albeit fruitier. But brewers have also made tropical tasting dry-hopped hazy beers with Audacia. That is why Indie founder Jim Solberg and brewery ambassador Matt Sage took to calling her a “sassy noble hop.” Because there is no Latin root for sassy they turned to the root for audacious to find a name for the new cultivar.

* HBC 1134 (9.8-12.5 alpha acids, 3-4.5% beta acids, 1.8-3% mL/100 grams total oil). From the Hop Breeding Company, a cross between Pure and an unpatented HBC male. Unlike landrace varieties and many American hops bred for use in lagers, 1134 often contains double digit alpha acids and has a high alpha/beta ratio.

“It is really unique to have a Yakima hop that is 11% and this delicate,” said Odell Brewing COO Brenda McGivney, whose brewery sponsored 1134 during her development. “It gives this beautiful floral aroma, some spiciness, a kiss of lemon.” The hop is central to Odell’s Lagerado, a 5% ABV lager.

As important, 1134 yields between 2,200 and 3,200 pounds per acre. That is a crazy amount more than landrace varieties or many bred to replace them.

* 2001006-084A (7.5-9% alpha acids, 1.6 mL/100 grams total oil). From the USDA public breeding program, a cross between Pure and 21360M. Notable for high geraniol content, with aromas described as floral, rose and lemongrass. Yielded 2,400 pounds per acre in first year on trellis. Picks in late September or early October, nicely distanced from the picking windows for popular varieties such as Citra or Mosaic.

WHAT, NO DANK?

Draught Lab has released its first two aroma training kits. Each kit “includes 5 hand-picked aromas and an interactive lesson that will teach the basic attributes of [the target style] based on the common hops and ingredients present in the style. A common off flavor is also included as an introductory lesson to beer quality.” Not surprisingly, they started with IPAs:

The aromas included in West Coast IPA are grapefruit, onion/garlic, resinous, pine, and an off flavor.

Included in Hazy IPA are pineapple, passion fruit, orange, catty/black currant, and an off flavor.

HOP PROFILE: HARLEQUIN

Pardon a quick bit of personal nostalgia. When I glanced at Antony Rudgard-Redsell’s badge at the Craft Brewers Conference in April, I naturally asked him if he were related to Tony Redsell, England’s best known hop grower. Indeed, he is Redsell’s grandson.

“Ninety-one years old and we still see him every day at the farm,” Rudgard-Redsell said.

In 1878, English farmers planted 71,000 acres of hops. This year, estimates are they will harvest fewer than 1,300. “There may be only 50-odd of us left (in England), but we’re a hardy bunch,” Redsell told me when I visited in 2011. “The hop to me is my life. The thought of getting up in the morning and not having some hops to look at, that would be terrible. I tend to think more about the hops than beer. For me, beer is a by-product of hops.”

The dramatic contraction of US hop acreage serves as a reminder that it takes a certain amount of persistent optimism to remain a hop farmer. Rudgard-Redsell, who was representing the British Hop Association at CBC, seems to have inherited that. He talked about Harlequin, and said some brewers consider it a proper substitute for Citra. “There’s reason to be optimistic,” he said.

Heritage: Released in 2019, Harlequin is product of a breeding program hop merchant Charles Faram established fewer than 15 years ago. She is a granddaughter of Jester, herself a daughter of Cascade.

The basics: 9.5-12% alpha acids, 7-9% beta acids, 1-1.6 mL/100 grams total oil.

Aroma qualities: Tropical, passionfruit, peach, and pineapple.