* Let’s hear it for the OG

* Who’s using all those hops?

* In search of the newest releases

* New inside the industry podcast

* Hop profile: Mount Hood

* Additional reading

Welcome to Vol. 8, No. 11. I’ve been thinking about how many hops a brewer, commercial or amateur, really needs in their portfolio. At this point, I am not ready to turn those thoughts into a random observation or something longer, but perhaps in the next few months. If you have an opinion, drop me a line at [email protected].

A SHOUTOUT FOR BB1

Yes, I have been known to ramble on about the importance of BB1, the wild hop from Manitoba that Ernest Salmon crossed with an English male in 1918 to produce Brewer’s Gold—and then how many popular varieties can be traced back to Brewer’s Gold. And Brewing Industry Guide even let me write about it.

I offer that as an explanation for why this beer can from Russian River Brewing is one of the few I will save. Take a close look at the megaphone.

LESSONS IN ALPHA

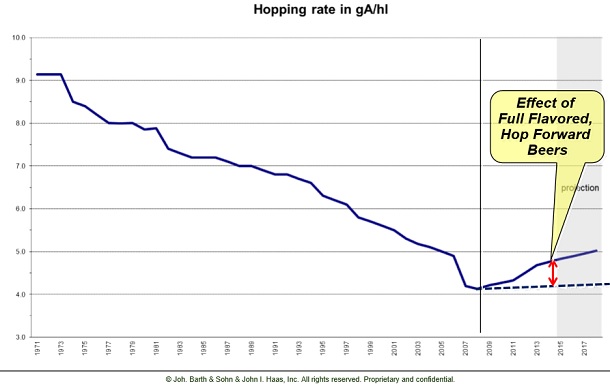

Alex Barth, then president of John I. Haas, showed this chart at the 2015 American Hop Convention. It tracks hop usage since 1971. One hundred years ago brewers used the equivalent of 12.6 grams of alpha acids per hectoliter (26.4 gallons, or 85% of a 31-gallon barrel). That had fallen to 9.1 grams in 1971 and continued to drop regularly until it was just over 4 grams in 2011. It ticked up to 4.5 grams in 2011, climbed in the years that followed, and will be about 4.7 grams this year.

Full flavored, hop forward beers reversed that hundred-year trend. Hopsteiner shared usage data from previous years and estimates for 2024 and 2025 at the 2025 hop convention. They included hop usage for mainstream, US craft, and other craft breweries. For 2025, the chart presented indicates US craft will account for 1.35% of production, but 15.4% of alpha demand.

Put another way, mainstream breweries will use 3.8 grams of alpha acids per liter and US craft brewers will use 54 grams. That doesn’t mean their beers will be 14 times more bitter, because most of those alpha acids are not isomerized. They are along for the ride when brewers make late additions to promote aroma and flavor.

Many of those mainstream breweries make those alpha acids go a long way, selling beers with single digit IBUs. But they make a lot of beer, need a lot of alpha, and prefer high alpha hops. Which is why one merchant recently told me, “Alpha still drives the bus.”

CAUTIOUS EXPANSION

My original plan for this space was to report how easy or hard it will be this year to buy the most recently named cultivars. But the answer, for the most part, turns out to be “it depends.” For instance, I can report that the Segal Ranch will expand acreage of Tangier from 25 acres to 50. However, because half of those are baby acres, John Segal has been conservative in writing contracts beyond what is committed to Hollingbery & Son and Russian River Brewing.

Right now, many brewers are more focused on using what they have on hand than adding to inventory. That does not make it easy for merchants to decide how much of variety—even one that excites brewers as much as Krush (formerly HBC 586)—to contract with farmers to grow.

“It’s certainly much more challenging to scale up new HBC (Hop Breeding Company) varieties in this soft market. With the prior ones, it seemed we could ‘just plant more’ each year and it was still not enough, given the strong market growth and brewer enthusiasm for new varieties. While Krush is an outstanding variety gaining some good traction, we have to be much more prudent in assessment of market demand and supply scale-up,” said Pete Mahony, John I. Haas vice president of supply chain and purchasing.

“While the interest is there, the new bookings are more cautious and tentative, a bit more baby-stepping, versus the quicker leaps with the prior varieties in peak of the craft market. It is incredibly important nowadays to have strong communication channels with our brewers trialing the new varieties. While the brewers have become more cautious, so have we, in terms of supply scale-up.”

Much is the same at Hopsteiner, which released Alora and Erebus in the past 18 months. Because two larger brewers made sizeable purchases, 2024 crop Alora is almost gone. “I don’t like it when we are in the position we are sold out,” said Doug Wilson, vice president of sales and marketing.

He said Hopsteiner will grow more Alora and Erebus for 2025 than they currently have contracts for, but will be careful not to speculate.

INSIDE BASEBALL HOPS

Roy Farms has launched a podcast, hosted by Mike Roy and Drew Gaskill. It is called “No Dirt, No Flowers” and can be found on Spotify, Apple, Amazon, and Pandora. In the first episode, they talk about what they will discuss twice a month for the next year. They could have been more specific, but Roy says future episodes “will be more pointed.” The introduction page on Spotify promises they will bring “a new level of transparency to the industry.”

I’m not about to predict if these trips down the industry rabbit hole will interest you, but I’ll be listening. I may even comment here on what I hear. Forty minutes in, they talk briefly about the tension between public hop breeding programs and private programs, a topic that will be discussed in an upcoming episode. Roy said that they public program lacks the focus and management that have made private programs successful.

The breeding program supported by the Hop Quality Group broke with the serves-many-masters approach to focus on finding “exotic” aromas and flavors. For instance, they measured for thiols early in the selection process. Expect an announcement about their first release any month now. However, HQG members have made it clear that they do not intend to become hop merchants. So we will see how management goes.

HOP PROFILE: MOUNT HOOD

Mount Hood was one of the hops on the “endangered variety” chart from Crosby Hops I shared in January. Acreage in Oregon has shrunk to 142 acres and is not reported in Washington. However, some is grown in Washington, and I wrote about the relationship between Tröegs Brewing and Segal Ranch for Brewing Industry Guide.

Not long after Hop Union CEO Ralph Olson retired in 2011, he talked about how hop farmers rushed to plant Mount Hood after she was released in 1989, betting on demand from Anheuser-Busch. Washington farmers planted 513 acres in 1990 and 1,827 by 1993. That was the peak. Washington acreage shrank to 107 acres by 2002. Oregon acreage was steadier, generally between 250 and 300 acres, including 324 acres as recently as 2016.

Tröegs uses Mount Hood in Perpetual IPA. When varieties, such as Mount Hood, are not widely grown, Tröegs may contract with more than one grower or merchant, production manager Andrew Dickson told me for the BIG story. “(One) concern is farms going out of business. My biggest concern is with varieties going away,” Dickson said.

Pelican Brewing brewmaster Darren Welch echoed that concern by commenting when Crosby Farms posted the chart on Instagram:

“Mt Hood hops are the signature hop for our one of our best selling and most loved beers. Been making it since 1996, so if Mt Hood disappears, I’ll have a real problem. These days my selections for Mt Hood are basically just one lot, take it or leave it. Fortunately, they have been good lots so far, but it doesn’t bode well.”

Heritage: A cross between a tetraploid Hallertau Mittlefrüh female and USDA male (19058M, which was a cross between Early Green from the UK and an unknown male).

The basics: 4-6% alpha acids, 5-8% beta acids, .9-2 mL/100 grams total oil.

Aroma qualities: She was described as “a new American noble aroma hop” when she was released, and the BarthHaas Aroma Compendium calls a particularly mild aroma her distinguishing feature. “The spicy aromatic notes in the raw hops are reminiscent of tarragon, chilli, rosemary, and fennel. In the cold infusion, the flavor profile of creamy-caramel honey nuances and floral notes is particularly pronounced.”

ADDITIONAL READING

Community hops. “It’s more than a hobby, it’s an involvement with a historic Kent tradition.”

Talking terroir in New Zealand. Tom Shellhammer, who gets cited often in this newsletter, is spending four months in New Zealand. In this interview, he talks about hop maturity and what he’s seen so far.